Story and photo by Evonna Moody

Stuttgart High School

More than 40 percent of service members, many with families, move between May 15 and August 15 (known in the military community as PCS season), according to the Department of Defense. Relocating often highlights the financial struggles military families face during this transition period. However, there are an abundance of resources available in regards to financial security.

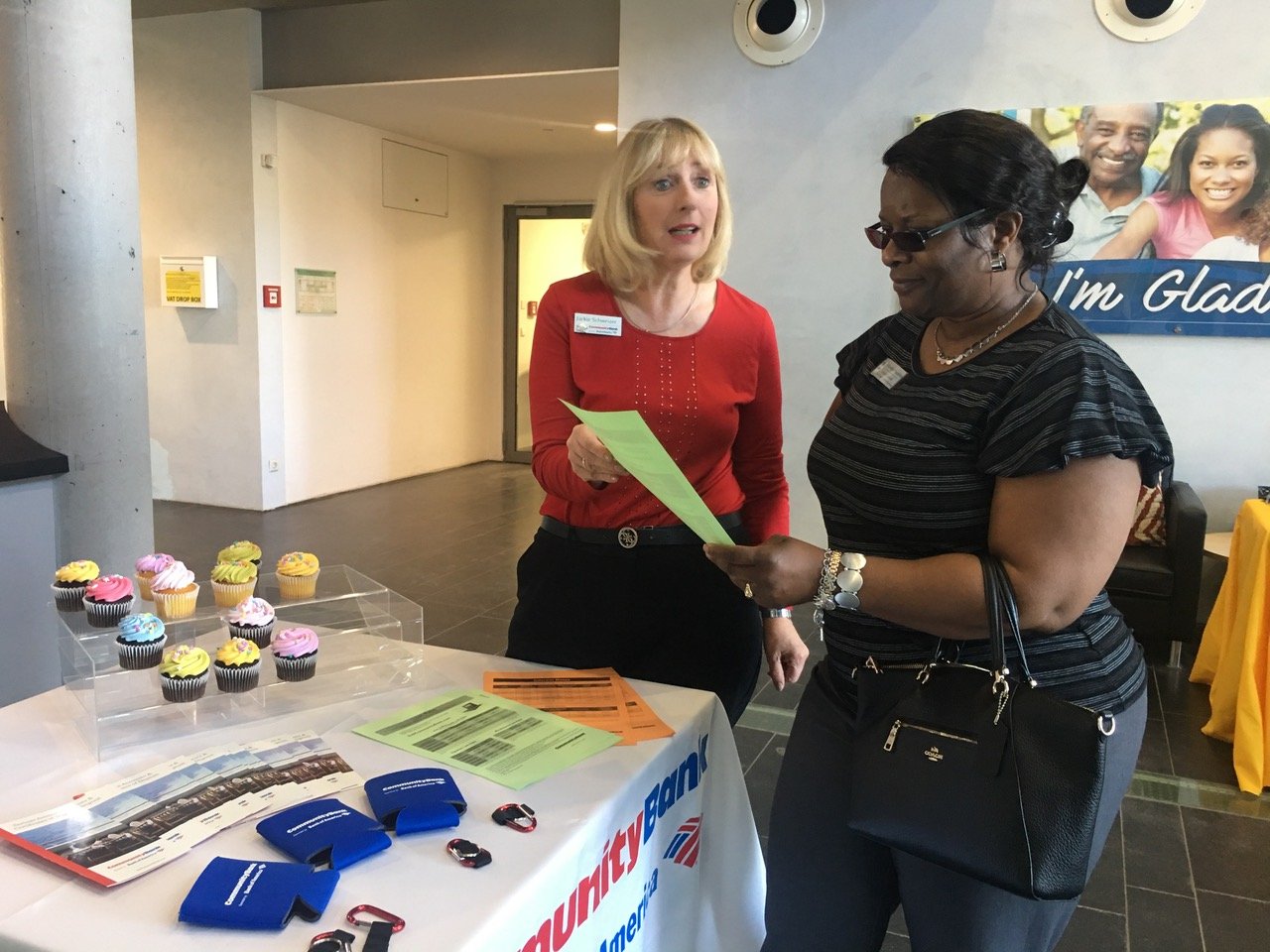

Since 2003, the DoD’s Financial Readiness campaign includes Military Saves Week, which annually occurs on installations around the world during the last week of February. USAG Stuttgart hosted its own Military Saves Week Resource Fair at Army Community Service, Panzer Kaserne, as a way to help better prepare local military families for the often unexpected financial challenges.

“Military Saves Week helps bring together different agencies, here, from the instillation to offer free resources to our community,” said Merilee Nevins, ACS financial readiness specialist and counselor and financial .

Helpful links to savings

- Thrift Savings Plan: A federal government-sponsored long-term retirement savings and investment plan, available for both federal civilian employees and members of the uniformed services.

- U.S. Savings Bonds: A shorter-term savings option with competitive interest rates and backed by the full faith and credit of the United States.

- Military Saves: A component of the nonprofit America Saves and a partner in the DoD’s Financial Readiness Campaign, Military Saves seeks to motivate, support and encourage military families to save money, reduce debt, and build wealth.

- Money Matters: A mobile-optimized resource with calculators for savings, debt reduction and other reference material in one location.

- Financial Literacy Game: A great way to learn about finances, integrating creativity, education and fun in a virtual world.

- Housing Resources for Military Members: The National Military Family Association has compiled a great list of resources to help military families struggling with the pitfalls of the housing crisis.

- Army OneSource: A network of the services and delivery of support to Soldiers and their families.

- Military OneSource: A DoD-funded program that provides comprehensive information on every aspect of military life at no cost to active duty, Army Reserve, National Guard and their families.

- Office of Servicemember Affairs: A component of the Consumer Financial Protection Bureau helps to educate and empower military members, veterans, and their Families in the consumer financial marketplace.

- Saveandinvest.org: A project of the FINRA Investor Education Foundation, a free, unbiased resource dedicated to your financial health. Helps you make informed decisions through easy-to-use tools and resources, and arms you with the information you need to protect yourself from investment fraud.

- Better Business Bureau Military Line: Provides specialized education and support services, which meets the needs of active and retired military personnel and their families.

Financial readiness is a priority for the DoD. For more information on financial readiness, contact Stuttgart ACS at https://stuttgart.armymwr.com/programs/army-community-service.

Even though the 2019 Resource Fair has past, the resources offered are available year, the Financial Readiness campaign continues throughout the entire year. Service members and families have access to informational books, special credit programs and opportunities for scholarships for dependents of service members all year long. For example, ACS participates in the Financial Readiness Program, offering free classes and counseling so military families can have a better understanding of budgeting, investing, and saving.

(Editor’s note: Evonna Moody is a senior at SHS and part of the Career Practicum program. She is interested in international relations and journalism.)